We always recommend trying to exhaust all resources to get a bank loan first. If you have been denied or just can’t quite pull it off in time, that is where Home Equity Partner can help.

If you are currently renting or looking for a rent to own home, the biggest factors will be getting your financial house in order via saving for a down payment and ensuring you make at least 3 times your expected monthly payment.

Additionally, we recommend visiting with The Village Family Service Center in Fargo ND (they also offer online consultations) for debt, credit, and money consultation. We are not affiliated with The Village but believe they truly help people and are a great non-profit.

Step 1. Contact Home Equity Partner with Questions

Home Equity Partner is prepared to answer your questions and make sure that this is the best option for you. We commonly refer people to banks for loans if we don’t think that is the best route for you

This also helps with any worries you may have. We can respond to any concerns or criticisms you may also have in regards to rent-to-own or lease options.

Step 2. Get a Down Payment Together

When you purchase a home on seller financing or through a bank the lender must consider that a certain percentage of sales come with risk. In order to off set this risk they will want a down payment. The higher the risk the higher the down payment required.

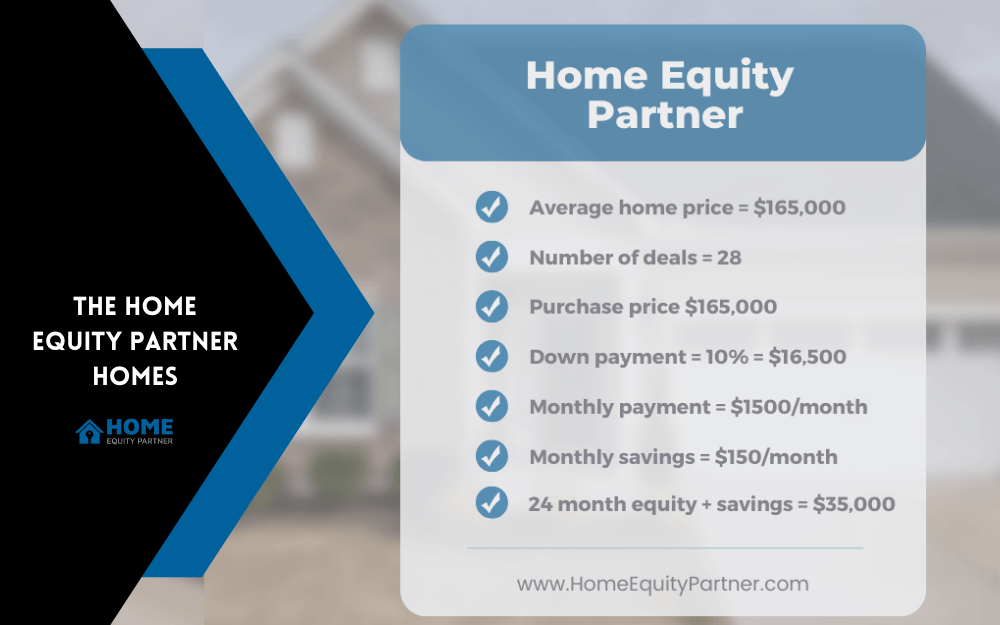

In the case of Home Equity Partner we and our investing look for a 10% down payment. This combined with debt, income, and monthly rent price can determine what the price of your house can be. You generally want to largest down payment you can put together while still being able to pay your current debts and rent.

Step 3. Apply to Home Equity Partner

LTS provides Home Equity Partner with a secure third party rental application for prospective rent-to-own applicants.

Applications are filled out by the prospective tenant to occupy a property. Categories include criminal background check, employment verification, landlord history, credit check, and personal profile. Requirements differ from traditional banks and rental applications.

$50 Non-refundable application fee per person*

Application Steps:

1.) www.LTservices.us

2.) Click LTS Applications

3.) Scroll down and click Full Screening Application

4.) Enter 3138-SYR in Landlord ID Number

5.) Click Continue to the Application

6.) Our information will automatically pop in.

7.) Start filling out the application.

Apply Here: https://homeequitypartner.com/application/

Step 4. Find a Realtor

Once you are approved and have a price range you can find a trusted realtor and start house hunting. Home Equity Partner can recommend realtors in most areas.

Realtors should know the area well and understand the markets. Don’t be afraid to ask your realtor some questions to make sure they know what they are doing and will get you a great home.

Realtors with real estate or construction backgrounds are a bonus!

Step 5. Negotiate and Accept Offers

Once you find a home in your price range and meets your needs you can work with Home Equity Partner to negotiate and accept an offer. Home Equity Partner will work with most homes even if we think the home is over priced. We can work with you and the seller to make a deal that benefits everyone.

Once this is done we may take some time to find an outside investor in some situations. With a good down payment we can likely find someone from out extensive list of contacts.

Step 6. Home Inspection

An inspection is the safest way to ensure you will be protected and understand exactly what kind of home you are buying. Similar to a regular bank financed property and purchase agreement, an inspection is a choice but is always recommended.

After a home inspection we may require a price adjustment or for additional repairs. In rare cases some deals may fall flat due to extreme issues.

Part 7. Closing

After a lot of negotiating and discussion we are ready to close. Get ready to signa lot of papers and do a little waiting.

Home Equity Partner purchases the home and you become a renter with a lease option or contract for deed. You get the keys and start living in your future home!

Part 8. Purchase

Depending on your contract for deal or option you will be purchasing a the home after 3-5 years depending on your contract. This is generally the amount of time you need to qualify for a traditional loan.

You get the loan and purchase the home yourself through a traditional bank. This is when you no longer deal with Home Equity Partner. Although, we can guide you if you have additional questions in this stage of your home ownership.

Your set to own your own home!