Blog

What is Escrow?

In escrow? Under contract? You're on the hunt for a property or just getting to know the market, and so you're going to come across some terms and jargon that are commonly used but may lead to confusion. What is escrow? It’s a financial...

A Guide to Property Taxes

Property Taxes - A Rundown With the season fast approaching and people wanting to get a jump start; let’s talk taxes. Property taxes are a tax assessed on real estate owners and are an inevitable part of owning a home. Despite this consistent expectation,...

Should I Get Home Insurance?

You can purchase insurance on just about anything. Should you get it on your home? Yes, and in most cases home insurance is actually required. Data from Zillow says roughly 37% of U.S. homeowners actually own their home outright. That leaves 63% still under...

Real Estate – Location & What’s Nearby

Just because it’s not on your property doesn’t mean it can’t impact the value of your property. It’s a behind-the-scenes thought that most people don’t consider. After all, you’re buying a homefor the home. You’ve had an appraiser assure the property is...

3 Mortgage Loan Category Types

Many individuals looking to become a homeowner start with online searches. Searching for homes they might like and mortgage loan options they may qualify for. Here are 3 very different mortgage loan options that you can use to find a home of your choice. ...

Do I Need A Realtor?

The general answer when it comes to needing a realtor is no, you don’t “Need” one. I might compare a realtor to a chef in that you don’t need them, but we do find them helpful and convenient. A realtor can help you with everything in finding, selecting, and buying...

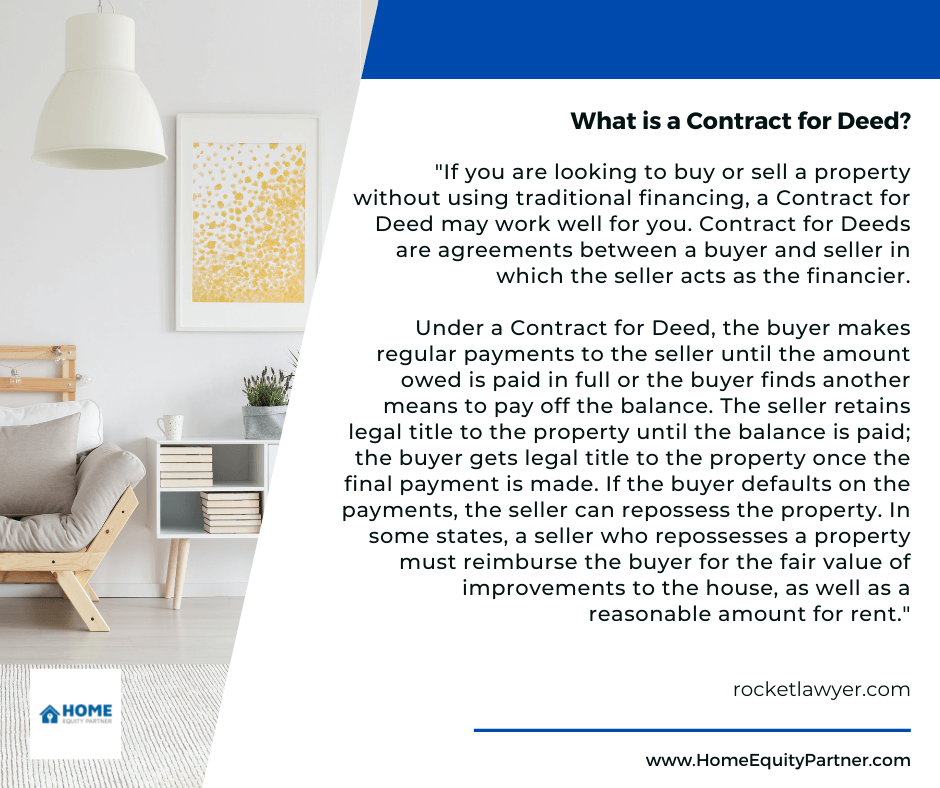

What Does Contract for Deed Mean?

First off; a deed is a legal document that transfers ownership of an asset from one to another. So what is a Contract for Deed? The seller, Sarah, signed over her real estate to Jerry, the buyer, by deed. Jerry owns the real estate. Now let’s build on this....

Rent-To-Own Scams

Beware of rent-to-own scams, unfortunately scams are all too common in this industry. “A recent ruling from an Allegheny County judge gave 285 Pennsylvania tenants the titles to their homes as compensation for being misled into predatory rent-to-own agreements with...

Buying A Home While Owning Small Business

Self-Employed and Small Business Homebuyer Issues No matter if you consider yourself a business owner, independent contractor, freelancer, self-employed individual, or gig worker you may struggle buying a home. This includes millions of Americans and grows every...

Advantages and Disadvantages of Contract for Deed Homes

Home Equity Partner has a lot to say about the advantages and disadvantages of Contract For Deed. Here are the biggest advantages and disadvantages when considering a Contract For Deed on your next home. Advantages of Contract for Deeds: Easier and ready to move...

Need A Home Inspection For A Contract For Deed?

No, But Highly Recommended A Home Inspection The short answer is you don’t need to get a home inspection before signing a contract for deed. Home Equity Partner recommends it though so you know what to expect for future home repairs and maintenance. This way...

Pitfalls of FHA Home Loans

Home Equity Partner has covered the basic advantages of FHA loans: Low credit score requirements Small down payment. Easy to qualify This makes FHA loans quite common for first-time homebuyers and people in unique situations. A common way to get into a home it...

Contract For Deed Pros & Cons

A Contract For Deed is a legal agreement, similar to a lease or mortgage, for the sale of property between a buyer and seller, an alternative to a mortgage. When you agree to a contract for deed, you as the buyer, make...

Do Credit Scores Really Matter?

Home Equity Partner is asked a lot about U.S. credit scores and what we use them for as it is part of the application process. We wanted to break this down and offer more about credit scores and how we use them. Banks often use credit scores as a key measurement of...

Right Time To Lock Into A Lease Option

Did you know that with a lease option you control whether or not you buy the home? If the market and home prices drop, you can walk. If home values continue to climb, you get the first right of refusal and can capture those appreciation gains. That is why in this...

Is Contract For Deed Right For You?

Contract for Deed Detailed Contract for deed can introduce a new solution if you can’t get a traditional home loan through a bank near where you are currently renting. Many individuals and families that come to Home Equity Partner to find their first home or condo...

Free And Clear If I Have A Down payment?

Down payments can be more complicated than you think for first-time home buyers. Down Payments are thought to be very straightforward but have a lot of stipulations and rules. First-time homebuyers seeking an FHA loan with less than 15% or 20% of a down payment...

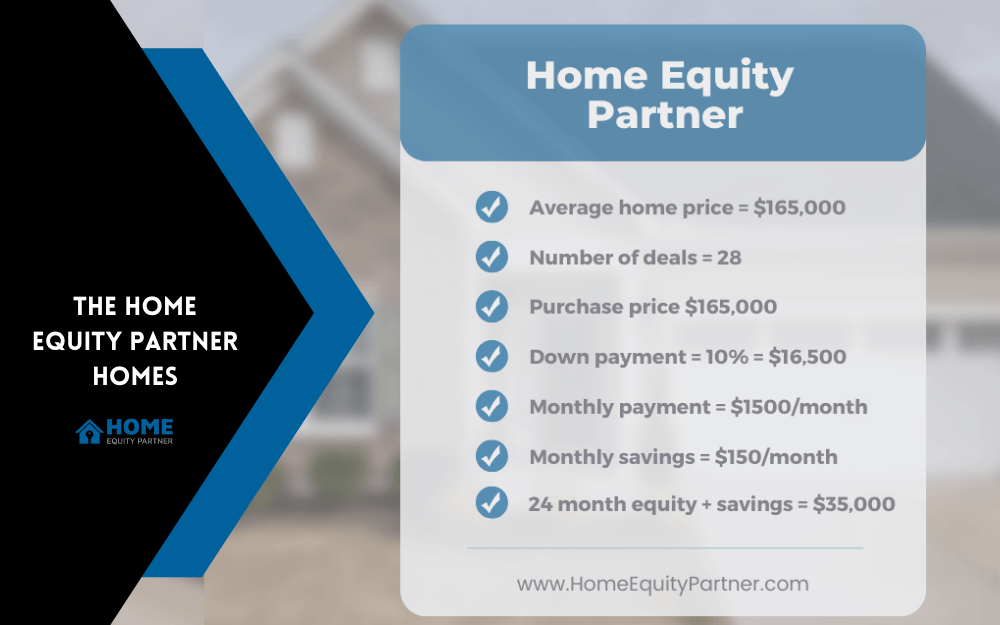

The Home Equity Partner Homes

Home Equity Partner has worked with many families and individuals over the years in a variety of circumstances to get them into a home. While the one thing that links all these people together is that they couldn't get a traditional home loan, the other important...

New Name, Same Company

Set Your Rent was our business name for several years and its purpose was to tell you that you can get a home and "set your rent" based on the home you buy. It was pretty catchy and served its purpose well. That being said it was confusing to many people and only...

Owner-Occupied vs Non-Owner-Occupied Effect Financing

Have you ever received a bill that was higher than you anticipated, and when you looked it over you found that there were one or more “additional fees” you were unaware of? It can happen with housing, too. Among all the specialized terminology relating to real...

Options In Fall 2021 Housing Market

The declaration of covid-19 pandemic in early 2020 as a national health emergency forced governments to impose movement restrictions to help contain the spread. This, together with other policies, adversely affected different sectors of the economy, the housing...

Ways You Can Be Competitive in a Red-Hot Summer Real Estate Market

Let’s face it: It’s tough being an aspiring home buyer right now in the United States real estate market. First, it’s basically a seller’s market which means prices are sky high and competition is at an equally historic level. While there are some programs out...

Self-Employed Mortgage Guide

The myth that the self-employed cannot get a mortgage is wrong. If you are self-employed, you probably already know that it could be harder to get a mortgage. If you want to own your own home but think it’s impossible as a self-employed individual, then keep...

Early 2021 Housing Market | Fargo, ND

You wouldn’t expect North Dakota’s largest city to be a hub for jobs involving computers and mathematics, but statistics bear this out. Yet, the Fargo Housing market is perfect for service professionals, blue-collar workers, management, and entrepreneurs alike....

Why is Rent to Own good for Investors?

Contrary to the popular misconception, the properties in Rent-to-own investments are not different from everyday traditional homes. The difference lies in the way they’re sold. These types of houses offer a reasonable alternative to bank mortgagees. Rent-to-own...

Why Is Rent To Own Good For Home Builders

Sometimes, home builders run into trouble trying to find someone to purchase a home as fast as they want. In this scenario, they could increase the odds of selling if they throw out a Rent-to-own option to people who are looking to purchase one. They might sound...

5 Lease to Own Problems and Solutions for Home Buyers

Today we’re going to talk about the five lease to own (a.k.a rent-to-own) problems, and solutions for home shoppers. The problems with lease to own homes come down to five things in our opinion: 1. Trust2. Bad Homes3. The Paperwork4. Not being the right fit5....

5 Tips For Your New Home

Also known as a lease-to-own or contract for deed, a rent-to-own home allows you to start paying towards the home purchase while you rent. When the lease ends you will have saved up credit that reduces the purchase price. What an exciting feeling to finally own...

Saving A Down Payment For A Lease-To-Own Contract

Saving money for the down payment doesn’t have to be hard. If you’re trying to understand how to save money, figure out how to spend less. There are endless resources that are available for you to use. These resources can help you manage and track your spending...

Simple Optimization Of Your Credit Score To Qualify For A Home Loan

How to Increase Your Credit Score If you are in a rent-to-own agreement or contract for a deed home, you’ll inevitably have to finance your house in your own name at some point. When the time comes, you should have the highest credit score possible, that way you...

The Pre-Approved Podcast

Becoming a Homeowner When The Bank Says No. The Pre-Approved Podcast is dedicated to the 1 in 10 home owners denied each year by the banks. We will discuss Rent-to-Own, Lease Options, Contract for Deed, Qualifying Mortgages, Non-QM Loans, and Private Mortgages. All...

Lease-To-Own Trends in 2021

Buying a house is a dream for many! Owning a house has its charm and comfort. Many people want to own a house but later find out that they don’t have enough money and miss the requirements that many banks have because of things they can’t control. Home Equity...

Selecting A Real Estate Agent for Lease-To-Own

Getting a High-Quality Realtor is the First Step to Finding an Ideal Lease-to-Own a Home If you are looking for a lease-to-own a home and are not sure where to start, a high-quality realtor should be your starting point. Lease-to-own is good for people who do not...

What Does Contract for Deed Mean For You?

A contract for deed an agreement between two people, a seller, and a buyer. It is most commonly used as a way to transfer ownernship of a home or piece of land over time. What this means is that an individual or a family can achieve home ownership even if they have...

8 Steps to Getting a Home Through Home Equity Partner

We always recommend trying to exhaust all resources to get a bank loan first. If you have been denied or just can’t quite pull it off in time, that is where Home Equity Partner can help. If you are currently renting or looking for a rent to own home, the biggest...

Rental vs Lease Option vs Contract for Deed

We understand that while most people are familiar with renting an apartment or home, the terms Lease Option or Contract for Deed can create confusion. Read more to understand the key differences and what's best for you. Home Equity Partner offers a variety of...

How To Find Rent-to-Own or Contract for Deed Homes Near You

We found it exhausting trying to find rent-to-own (aka lease option) or contract for deed homes. We spent hours researching this in the region and wanted to share our experience and tips to hopefully save you a lot of time. Since each city/state is unique, the...

What You Need to Know About Rent to Own Homes

A rent to own contract is a way for an individual or a family to begin to reap some of the benefits of home ownership without having to be lender approved or put down a large down payment on a home. With rent to own homes, there are fewer barriers to entry than one...

What is Escrow?

In escrow? Under contract? You're on the hunt for a property or just getting to know the market, and so you're going to come across some terms and jargon that are commonly used but may lead to confusion. What is escrow? It’s a financial...

A Guide to Property Taxes

Property Taxes - A Rundown With the season fast approaching and people wanting to get a jump start; let’s talk taxes. Property taxes are a tax assessed on real estate owners and are an inevitable part of owning a home. Despite this consistent expectation,...

Should I Get Home Insurance?

You can purchase insurance on just about anything. Should you get it on your home? Yes, and in most cases home insurance is actually required. Data from Zillow says roughly 37% of U.S. homeowners actually own their home outright. That leaves 63% still under...

Real Estate – Location & What’s Nearby

Just because it’s not on your property doesn’t mean it can’t impact the value of your property. It’s a behind-the-scenes thought that most people don’t consider. After all, you’re buying a homefor the home. You’ve had an appraiser assure the property is...

3 Mortgage Loan Category Types

Many individuals looking to become a homeowner start with online searches. Searching for homes they might like and mortgage loan options they may qualify for. Here are 3 very different mortgage loan options that you can use to find a home of your choice. ...

Do I Need A Realtor?

The general answer when it comes to needing a realtor is no, you don’t “Need” one. I might compare a realtor to a chef in that you don’t need them, but we do find them helpful and convenient. A realtor can help you with everything in finding, selecting, and buying...

What Does Contract for Deed Mean?

First off; a deed is a legal document that transfers ownership of an asset from one to another. So what is a Contract for Deed? The seller, Sarah, signed over her real estate to Jerry, the buyer, by deed. Jerry owns the real estate. Now let’s build on this....

Rent-To-Own Scams

Beware of rent-to-own scams, unfortunately scams are all too common in this industry. “A recent ruling from an Allegheny County judge gave 285 Pennsylvania tenants the titles to their homes as compensation for being misled into predatory rent-to-own agreements with...

Buying A Home While Owning Small Business

Self-Employed and Small Business Homebuyer Issues No matter if you consider yourself a business owner, independent contractor, freelancer, self-employed individual, or gig worker you may struggle buying a home. This includes millions of Americans and grows every...

Advantages and Disadvantages of Contract for Deed Homes

Home Equity Partner has a lot to say about the advantages and disadvantages of Contract For Deed. Here are the biggest advantages and disadvantages when considering a Contract For Deed on your next home. Advantages of Contract for Deeds: Easier and ready to move...

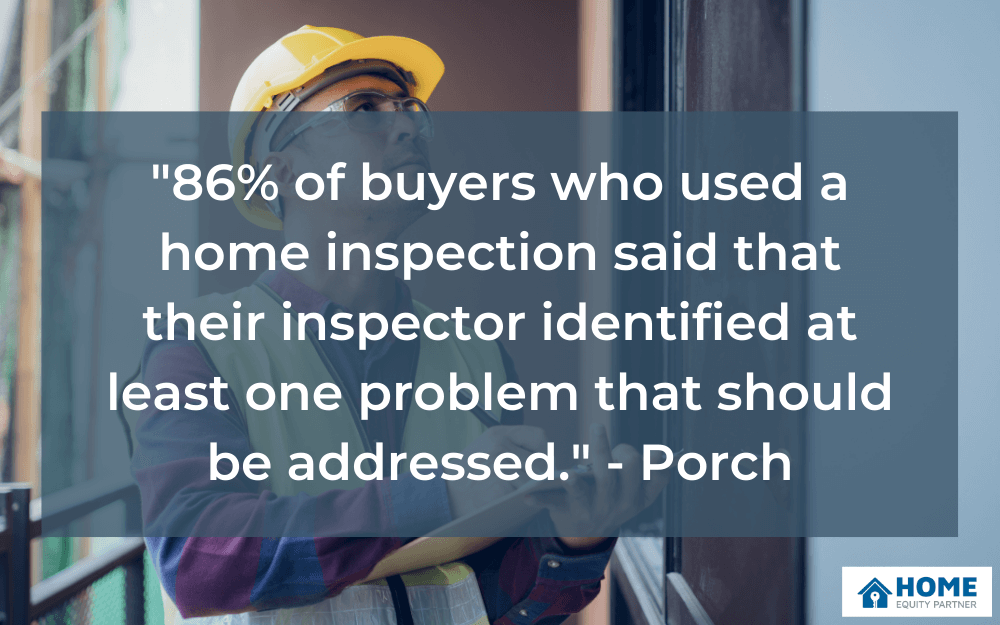

Need A Home Inspection For A Contract For Deed?

No, But Highly Recommended A Home Inspection The short answer is you don’t need to get a home inspection before signing a contract for deed. Home Equity Partner recommends it though so you know what to expect for future home repairs and maintenance. This way...

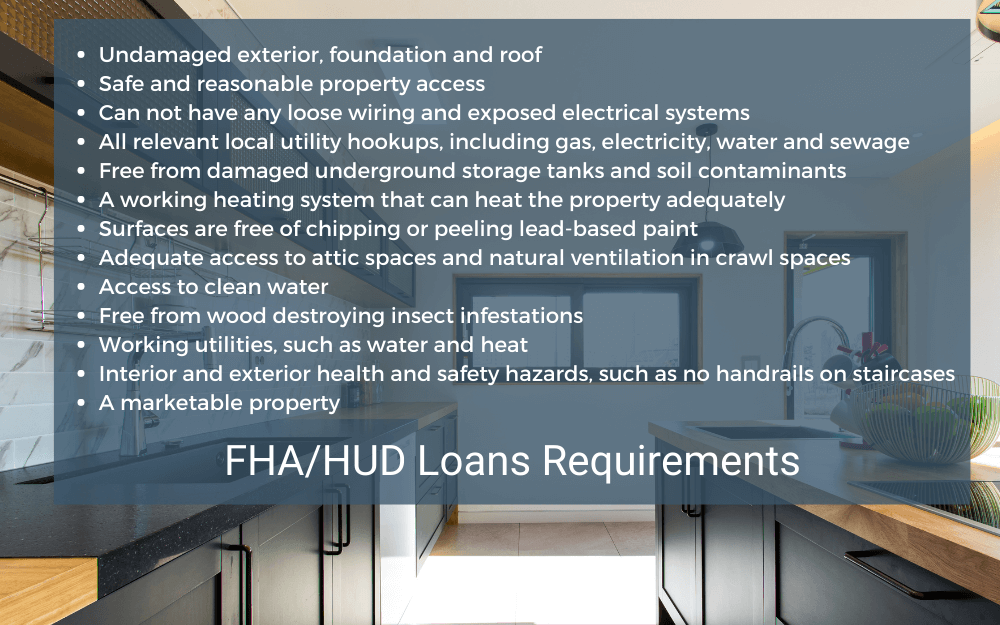

Pitfalls of FHA Home Loans

Home Equity Partner has covered the basic advantages of FHA loans: Low credit score requirements Small down payment. Easy to qualify This makes FHA loans quite common for first-time homebuyers and people in unique situations. A common way to get into a home it...

Contract For Deed Pros & Cons

A Contract For Deed is a legal agreement, similar to a lease or mortgage, for the sale of property between a buyer and seller, an alternative to a mortgage. When you agree to a contract for deed, you as the buyer, make...

Do Credit Scores Really Matter?

Home Equity Partner is asked a lot about U.S. credit scores and what we use them for as it is part of the application process. We wanted to break this down and offer more about credit scores and how we use them. Banks often use credit scores as a key measurement of...

Right Time To Lock Into A Lease Option

Did you know that with a lease option you control whether or not you buy the home? If the market and home prices drop, you can walk. If home values continue to climb, you get the first right of refusal and can capture those appreciation gains. That is why in this...

Is Contract For Deed Right For You?

Contract for Deed Detailed Contract for deed can introduce a new solution if you can’t get a traditional home loan through a bank near where you are currently renting. Many individuals and families that come to Home Equity Partner to find their first home or condo...

Free And Clear If I Have A Down payment?

Down payments can be more complicated than you think for first-time home buyers. Down Payments are thought to be very straightforward but have a lot of stipulations and rules. First-time homebuyers seeking an FHA loan with less than 15% or 20% of a down payment...

The Home Equity Partner Homes

Home Equity Partner has worked with many families and individuals over the years in a variety of circumstances to get them into a home. While the one thing that links all these people together is that they couldn't get a traditional home loan, the other important...

New Name, Same Company

Set Your Rent was our business name for several years and its purpose was to tell you that you can get a home and "set your rent" based on the home you buy. It was pretty catchy and served its purpose well. That being said it was confusing to many people and only...

Owner-Occupied vs Non-Owner-Occupied Effect Financing

Have you ever received a bill that was higher than you anticipated, and when you looked it over you found that there were one or more “additional fees” you were unaware of? It can happen with housing, too. Among all the specialized terminology relating to real...

Options In Fall 2021 Housing Market

The declaration of covid-19 pandemic in early 2020 as a national health emergency forced governments to impose movement restrictions to help contain the spread. This, together with other policies, adversely affected different sectors of the economy, the housing...

Ways You Can Be Competitive in a Red-Hot Summer Real Estate Market

Let’s face it: It’s tough being an aspiring home buyer right now in the United States real estate market. First, it’s basically a seller’s market which means prices are sky high and competition is at an equally historic level. While there are some programs out...

Self-Employed Mortgage Guide

The myth that the self-employed cannot get a mortgage is wrong. If you are self-employed, you probably already know that it could be harder to get a mortgage. If you want to own your own home but think it’s impossible as a self-employed individual, then keep...

Early 2021 Housing Market | Fargo, ND

You wouldn’t expect North Dakota’s largest city to be a hub for jobs involving computers and mathematics, but statistics bear this out. Yet, the Fargo Housing market is perfect for service professionals, blue-collar workers, management, and entrepreneurs alike....

Why is Rent to Own good for Investors?

Contrary to the popular misconception, the properties in Rent-to-own investments are not different from everyday traditional homes. The difference lies in the way they’re sold. These types of houses offer a reasonable alternative to bank mortgagees. Rent-to-own...

Why Is Rent To Own Good For Home Builders

Sometimes, home builders run into trouble trying to find someone to purchase a home as fast as they want. In this scenario, they could increase the odds of selling if they throw out a Rent-to-own option to people who are looking to purchase one. They might sound...

5 Lease to Own Problems and Solutions for Home Buyers

Today we’re going to talk about the five lease to own (a.k.a rent-to-own) problems, and solutions for home shoppers. The problems with lease to own homes come down to five things in our opinion: 1. Trust2. Bad Homes3. The Paperwork4. Not being the right fit5....

5 Tips For Your New Home

Also known as a lease-to-own or contract for deed, a rent-to-own home allows you to start paying towards the home purchase while you rent. When the lease ends you will have saved up credit that reduces the purchase price. What an exciting feeling to finally own...

Saving A Down Payment For A Lease-To-Own Contract

Saving money for the down payment doesn’t have to be hard. If you’re trying to understand how to save money, figure out how to spend less. There are endless resources that are available for you to use. These resources can help you manage and track your spending...

Simple Optimization Of Your Credit Score To Qualify For A Home Loan

How to Increase Your Credit Score If you are in a rent-to-own agreement or contract for a deed home, you’ll inevitably have to finance your house in your own name at some point. When the time comes, you should have the highest credit score possible, that way you...

The Pre-Approved Podcast

Becoming a Homeowner When The Bank Says No. The Pre-Approved Podcast is dedicated to the 1 in 10 home owners denied each year by the banks. We will discuss Rent-to-Own, Lease Options, Contract for Deed, Qualifying Mortgages, Non-QM Loans, and Private Mortgages. All...

Lease-To-Own Trends in 2021

Buying a house is a dream for many! Owning a house has its charm and comfort. Many people want to own a house but later find out that they don’t have enough money and miss the requirements that many banks have because of things they can’t control. Home Equity...

Selecting A Real Estate Agent for Lease-To-Own

Getting a High-Quality Realtor is the First Step to Finding an Ideal Lease-to-Own a Home If you are looking for a lease-to-own a home and are not sure where to start, a high-quality realtor should be your starting point. Lease-to-own is good for people who do not...

What Does Contract for Deed Mean For You?

A contract for deed an agreement between two people, a seller, and a buyer. It is most commonly used as a way to transfer ownernship of a home or piece of land over time. What this means is that an individual or a family can achieve home ownership even if they have...

8 Steps to Getting a Home Through Home Equity Partner

We always recommend trying to exhaust all resources to get a bank loan first. If you have been denied or just can’t quite pull it off in time, that is where Home Equity Partner can help. If you are currently renting or looking for a rent to own home, the biggest...

Rental vs Lease Option vs Contract for Deed

We understand that while most people are familiar with renting an apartment or home, the terms Lease Option or Contract for Deed can create confusion. Read more to understand the key differences and what's best for you. Home Equity Partner offers a variety of...

How To Find Rent-to-Own or Contract for Deed Homes Near You

We found it exhausting trying to find rent-to-own (aka lease option) or contract for deed homes. We spent hours researching this in the region and wanted to share our experience and tips to hopefully save you a lot of time. Since each city/state is unique, the...

What You Need to Know About Rent to Own Homes

A rent to own contract is a way for an individual or a family to begin to reap some of the benefits of home ownership without having to be lender approved or put down a large down payment on a home. With rent to own homes, there are fewer barriers to entry than one...

Don’t Wait Any Longer.

Let Us Help You Purchase Your Dream Home Today!

Follow Us

Contact Us

Navigate

Contact Us

Follow Us